What You Need to Know About IRR

- Jay Chang

- Jun 27, 2020

- 3 min read

Internal Rate of Return (IRR) is commonly used to measure the investment’s rate of return. In real estate, it’s a great metric for evaluating and comparing different deals.

Generally, a deal with higher IRR is better; however, some investors may prefer lower IRR if the deal provides lesser risk and healthier cash flow over a longer period.

In this article, we’ll talk about the fundamentals and misconceptions of IRR, when to use XIRR (Extended IRR) or MIRR (Modified IRR), and how to utilize them appropriately.

Understanding IRR

When calculating the IRR of the investment, you’re taking into account the time value of money and assuming that each distributed cash flow is being reinvested at the same IRR.

Here’s the formula (Formula 1):

Let’s reorganize this formula by moving CF0 to the other side and multiplying everything by (1+IRR)n (Formula 2):

Note that CF0 is typically your initial investment, which is negative.

Looking at Formula 2, do you see how each distributed cash flow, i.e. CF1 and CF2, are being reinvested at the same rate as IRR?

This is never the case!

For example, a person received $1,000 check as rental income last month. What do you think the person did with that money?

The person is most likely spending a portion of that $1,000 or depositing it into a savings account that generates 0.1% annualized return!

Truth About IRR

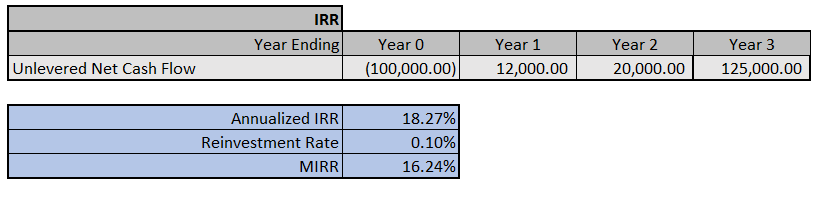

The heartbroken truth is that when you think you made 18.3% annualized IRR on an investment, you probably made closer to 16.2%.

Table A: IRR vs MIRR

I won’t go too much into the details on MIRR (Modified IRR), but it essentially allows you to use a more realistic reinvestment rate in lieu of the IRR. In this case, I assumed 0.1% reinvestment rate for the MIRR, an accurate scenario if the person were to put all his rental income into a savings account.

Although IRR isn’t as accurate as MIRR, this is what most investors use to evaluate deals. Just remember when you look at IRRs in the future, take some percentage points off that number, and that’s how much you’re making.

Understanding XIRR

XIRR (Extended IRR) is great for nonperiodic cash flows, which means it considers the date of distribution. This is something that both MIRR and IRR can’t do easily, which require periodic cash flows.

In real estate, XIRR is typically used to calculate returns for monthly distributions. This means that each monthly cash flow is reinvested at the same XIRR. Thus, monthly cash flow is more aggressive relative to annual cash flow.

Table B: IRR vs XIRR

As shown in Table B, the annualized IRR when calculating annual distribution is 24.89%, while the XIRR based on monthly distribution is 26.16%.

Most of the investors use IRR instead of XIRR. But if you ever run into a syndicator presenting you a deal using XIRR with monthly distribution, just remember it’s a slightly more aggressive projection.

Table C: Converting Monthly IRR to Annualized IRR

As a bonus, I’d like to quickly show you how to apply IRR for monthly distribution. This will also help you understand the concept of XIRR and IRR.

The monthly IRR in Table C is very easy to calculate. It’s just “IRR(C6:AA6)”

To convert the Monthly IRR to Annualized IRR, you can’t just use “C9*12”, because this doesn’t take into account the compounding effect.

Instead, use “(1+C9)^12-1” to calculate for the Annualized IRR

So why is the Annualized XIRR 26.16%, while the Annualized IRR 26.20%? This is because the Annualized IRR assumes that every month is a 30-day month, meanwhile XIRR takes into account odd months, such as February, that have different number of days.

By assuming that every month is a 30-day month, the Annualized IRR is providing the same amount of cash flow in a shorter duration of time, thus a slightly higher rate of return.

I hope that you now understand IRR a lot better and are better at evaluating real estate deals. For ease of calculation and comparison, I’d just stick with IRR and annualized distribution. This is most commonly used, so you’ll be able to compare with other people’s investment projections more easily.

Comment below to let us know what other investment metrics you use to evaluate and compare deals.

Comments